Trusts are so pervasive in our world. They really can be the answer to all the problems in an estate plan – Have a disabled son? Answer: trust. Have a drug addicted nephew you want to help? Answer: trust. Want to support your new spouse but still help your children? Answer: trust….

The types of trusts range from formal, multigenerational trusts to oral arrangements interpreted by a court to impose a trust. We will review these various forms, including family trusts, alter ego trusts, spousal trusts, resulting trusts, and bare trusts, along with some of the tax aspects of each form, and when each type might be useful.

We will also review the roles and responsibilities of the various people involved– Settlor, Trustee, Beneficiaries, and Protectors. And to help us sleep at night we will cover some tips, and some pitfalls to avoid in drafting these ever so flexible and useful tools to help with our clients’ estate planning.

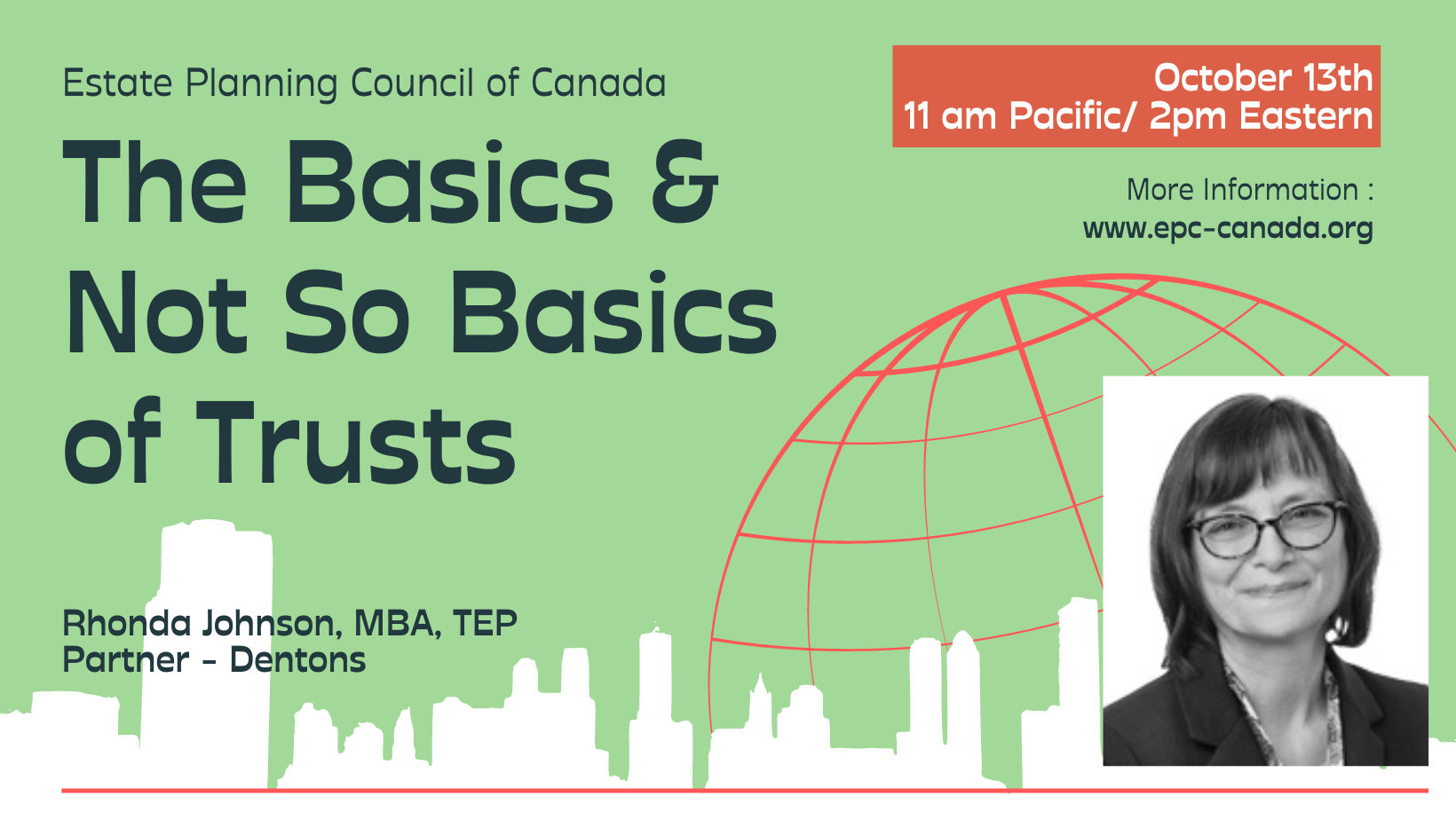

Rhonda Johnson, MBA, TEP - Partner, Dentons

Rhonda is a partner practicing in our Trusts, Estates and Wealth Preservation group. She focuses on trusts, estate planning and estate administration solutions advising individuals, trustees, business founders and next generations, including helping clients with assets in BC and Alberta. Her practice includes drafting inter vivos and testamentary trusts, First Nations Trusts, multiple wills planning, incapacity planning, charitable giving, wealth transfer strategies and multi-generational planning.

Rhonda has been a sessional instructor of the wills course for the Law Faculty of University of Alberta, and an instructor and presenter for the Legal Education Society of Alberta, CBA Wills Section, STEP National, STEP Edmonton, STEP Calgary, and Cambridge Forums. She has also been a sessional instructor in economics for North Island College.

Registration $25

No Charge for Estate Planning Council of Canada Members

Guests are welcome - this event is for professional Advisors only.